For years I’ve been asked this question and many like it. Why would anyone trust Bitcoin? Why would you think Bitcoin would have value when it cannot be “backed” by anything tangible or a government? Why would I put money into a currency that has already grown over 35,000% – haven’t I missed the boat? What happens if someone hacks “it?” Can someone get their hands on our money? How can you protect against risk? WHy do people call it “the new gold” or a “store of wealth?”

In 2011 I had all these same questions. And all of them are valid………… – at first.

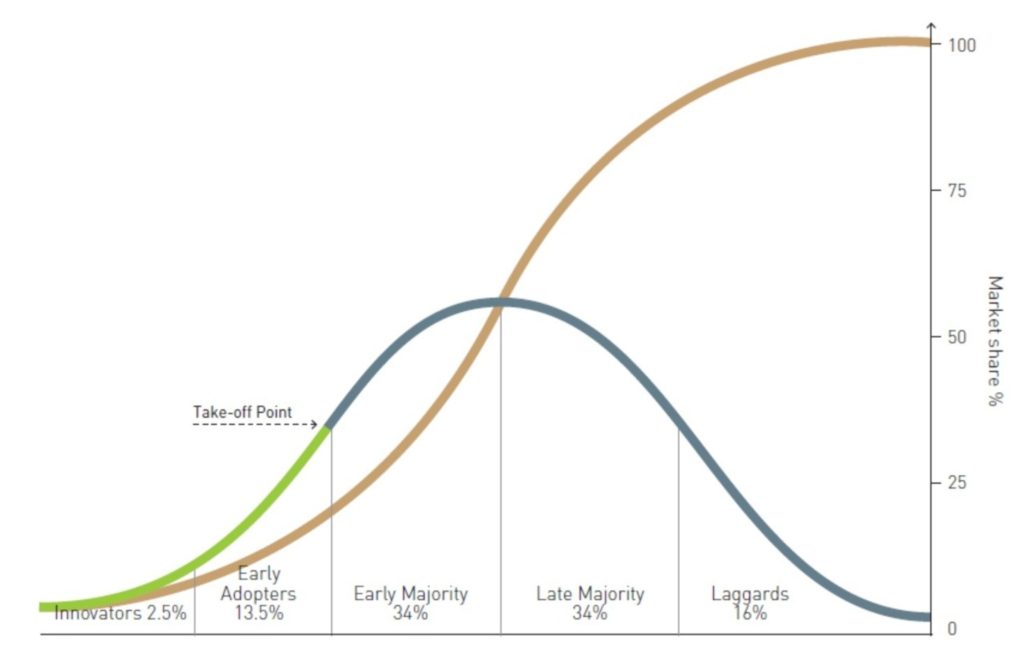

Let me back up. Here we are in the early stages of the 4th “Crypto Spring & Summer” as it were, since Bitcoin launched in early 2009. AND still today, it’s nice to see so many people who have an open mind and questions about something that is still so new, “unproven,” or mass-adopted yet. If you are asking any of these questions, then you, my friend, are already far ahead on the technology adoption timeline than 98% of all others.

I’ll share what I’ve researched and also an article to help answer your question.

In 2011 I invested in a technology incubator that was going to launch young tech startups into the stratosphere. The day I sat down to cut the check, one of my partners told me to put that money into Bitcoin rather than our incubator. That measly $20,000 would be worth $29,330,400 in 2017 or 2020 Bitcoin dollars. The incubator became a non-profit and my 20k is worth zero. Do I still get to help young entrepreneurs launch their tech companies? Sure, and I enjoy it. Yet, since that day, I waited and waited and waited some more (“Oh, once it get’s back down under$250 I’m in” I said) and waited some more.. to finally buy in after watching it cross the $1,000 dollar mark. My belief each time I did not buy was that I had missed the boat or that surely it was volatile enough to get back down to my ideal price point – where I thought I “Deserved” to buy it after all my years of following along without it. What I did not get through my skull is that it is an algorithm; a transparent, immutable, hack-proof algorithm. It cannot be changed, or artificially inflated (well, maybe unless your are Jamie Dimon*).

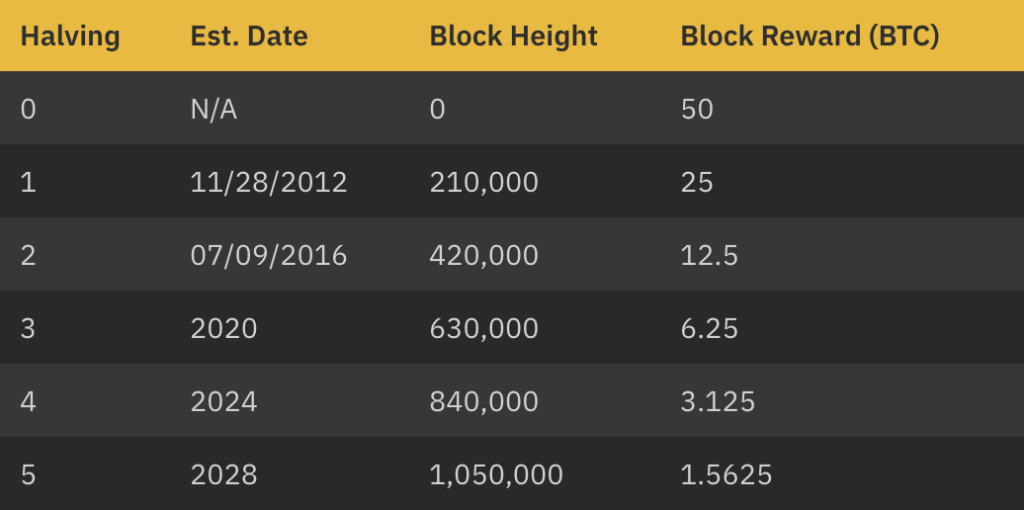

The biggest reason it’s value will continue to increase over the long term is because that algorithm has a stopping point. It ends. It stops producing blocks at 21 million. That limited number which cannot change (or be increased or devalued by printing more) creates a natural inflation. It creates a genuine need-based inflation and thus a true value. As you and I both know, The value of anything we wish to barter is based only on the value we assign it. If I’m starving in a desert with only a gold coin in my pocket and you are the only person in site and you have a banana, then to me I guarantee you that your banana is worth my gold coin. This is where the value of FIAT which is assigned a value by a third party begins to fall apart. This is why cryptocurrency will eventually replace most Fiat’s at least for progressive people and those forced to by their corrupt governments (can you say Most every country), but these topics are for another day and a longer forum. I’m posting this on my own blog shortly with more detail and an ongoing forum, but I’m glad that you got me thinking and willing to share. You may never find a use or a need personally. But if you live beyond the next 8-10 years you will at least witness a large adoption and a plethora of use-case scenarios whether it’s strictly in Bitcoin or in similar cryptocurrencies that have proven themselves in their own use cases. It’s like witnessing the explosive growth of the internet since 1992, and at this stage we are in now it is like discussing (and projecting the growth of) the internet in year 1993. We are in 1993-1994 right now. Do you see the Rogers Adoption of technology Bell curve diagram above? Do you see where a delineating inflection point at 2.5% of the population sits? Good. Now think about this. Only 1.2% – 1.3% of the connected world are involved in any cryptocurrency right now.** We all still have time, not much, but time, to fall in that 2.5% or that early adopters range. Remember that when you think you waited too long and when you have that $100 you might blow on some bike part or nice dinner, or shirt you don’t need. Investing in crypto is becoming increasingly popular, and finding the best crypto exchange to trade on can greatly impact your investment success.

I look forward to looking back on these discussions a few years from now (differently from how I look back on my 20k mistake 8 years ago.

I will gladly share more of my knowledge on cryptocurrencies and how it is already changing the world. Like dollar inflation since 1971, it is already happening. – Nelson Wells, Athens, Georgia . For more follow me here and on Twitter at @Clermont1

- * JP Morgan buys $9M Bitcoin while CEO Jamie Dimon trashes it to lower the price

- ** Total Worldwide Users of Bitcoin by Alex Lielacher According to his article this is the breakdown currently in 2020:

Bitcoin Users At a Glance

- Over 42 million bitcoin wallets had been set up globally by Dec 2019

- An estimated five percent of Americans hold bitcoin

- There are 7.1 million “active” bitcoin users

- Leading exchange Coinbase has over 13 million users

- Emerging markets users, who are often not considered in statistics, are

likely in the millions

Nelson Wells is a CEO, a publicist, and a contributor of cryptocurrency articles from Athens, Georgia . For more follow him on Twitter at @Clermont1